Stock Indicator ML

A lightweight Machine Learning model that predicts the stock market using years of S&P 500 data

Project Overview

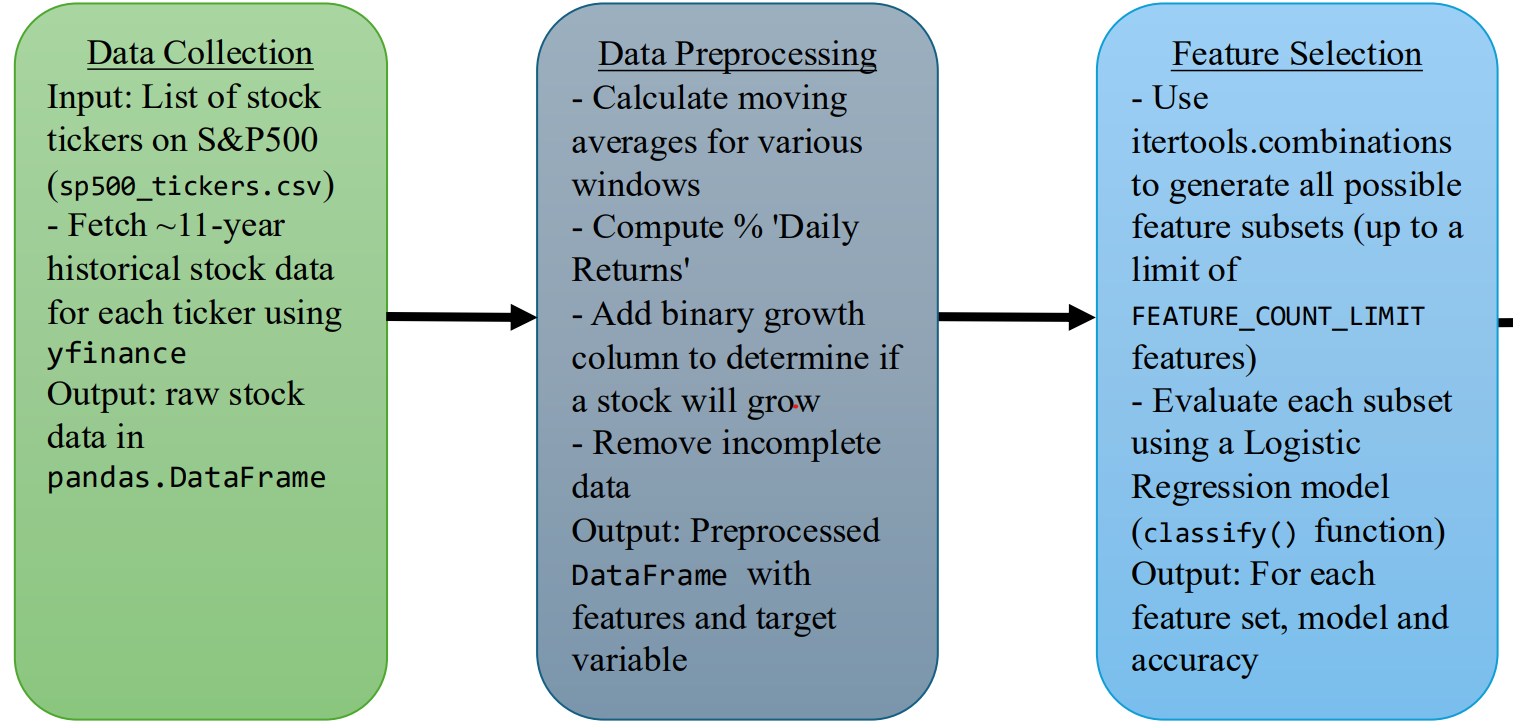

This machine learning project focuses on stock market prediction using historical S&P 500 data. The lightweight model analyzes market patterns, technical indicators, and price movements to provide predictions for stock market trends and potential investment opportunities.

Key Features

- • S&P 500 data collection using yFinance API

- • Technical indicator calculation (RSI, MACD, Moving Averages)

- • Feature engineering for price patterns and volume analysis

- • Machine learning model training on historical data

- • Stock price prediction and trend analysis

- • Logistic Regression model

- • Risk assessment and confidence scoring

- • Lightweight and efficient processing pipeline

Technical Approach

- • Data collection from Yahoo Finance API (yFinance)

- • Feature engineering with technical indicators

- • Data preprocessing and normalization

- • Logistic Regression model

- • Cross-validation for model reliability

- • Performance evaluation with financial metrics

- • Visualization of predictions and market trends

Results & Insights

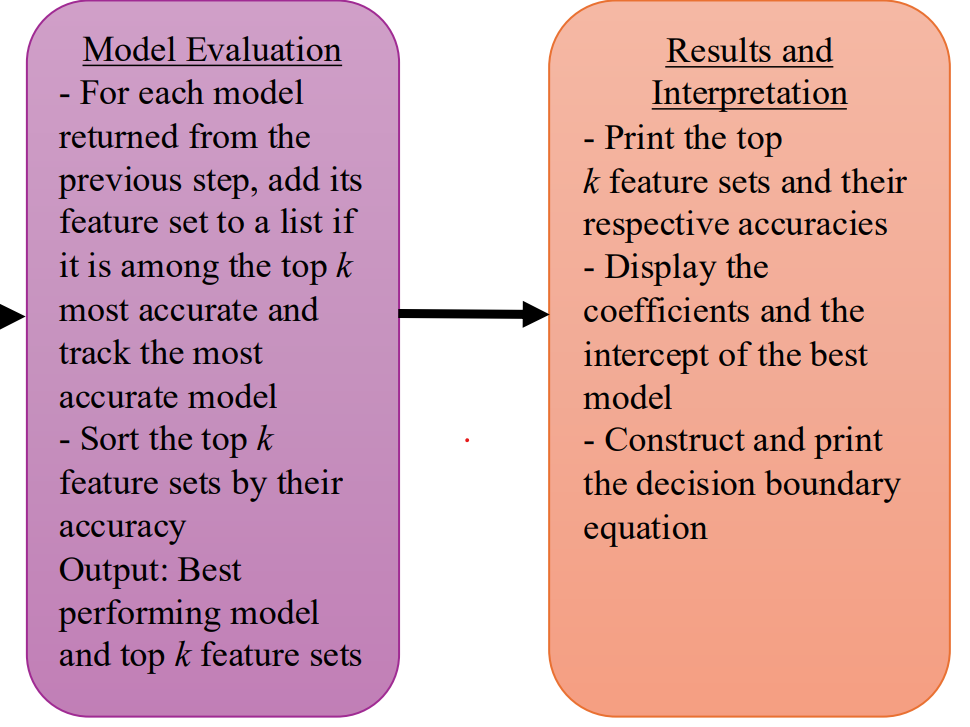

Model Performance

Successfully predicted stock market trends with around 80% accuracy. Weighs features like Daily Return much higher than other features.

Improvements

A more complex model such as K nearest neighbors would greatly improve the accuracy of the model. A quicker addition that could improve accuracy would be PCA for dimension reduction. Also could run it with more than 4 features in a set but was limited by computational power/time.

Accuracy

Model

Features Chosen